The future of accounting careers in 2025 is exceptionally promising, shaped by robust job market growth, rapid digital transformation, and a persistent talent shortage in the finance and accounting sector. India’s job market is projected to grow by 9% in 2025, with the finance and accounts sector expected to see an 8% increase in hiring for roles that prioritize digital tools, compliance, and sustainability metrics. This growth is driven by the expansion of industries such as IT, retail, telecommunications, and BFSI, all of which rely heavily on accounting professionals for financial management, regulatory compliance, and strategic insight.

A key driver of this demand is the global talent crunch in accounting, which has led U.S. and multinational firms—including RSM US, Moss Adams, Sikich, and CohnReznick—to expand their operations in India and actively recruit accountants and auditors to fill critical positions. The shortage is so acute that companies like Mattel have faced delays in essential filings due to a lack of qualified professionals. This surge in recruitment is also boosting enrollment in specialized commerce and accounting courses, reinforcing India’s position as a global talent destination for finance and accounting.

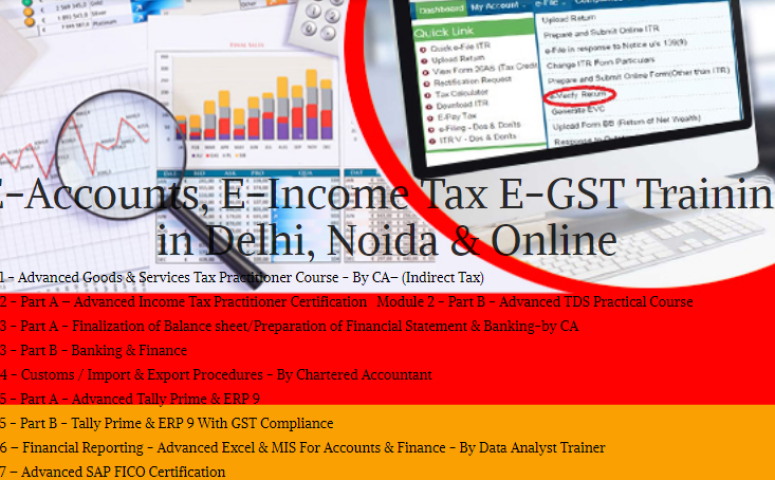

Accounting Training Course in Delhi

Employers are increasingly seeking candidates who can combine core accounting knowledge with advanced digital and regulatory skills. Proficiency in SAP FICO, GST, ITR & DTC, and Tally Prime is now essential for managing modern financial operations, ensuring compliance with India’s complex tax landscape, and leveraging data analytics for business insights. Automation and AI are streamlining routine tasks, but they are not replacing accountants; instead, they are creating new opportunities for professionals who can interpret data, ensure compliance, and provide strategic advice.

The “100% Job, Accounting Certification Course in Delhi, 110048 – Free SAP FICO Certification” by SLA Consultants India is specifically designed to meet these evolving industry needs. The curriculum covers foundational accounting principles as well as advanced digital tools and regulatory frameworks, ensuring graduates are job-ready and competitive in a rapidly changing market. With a 100% job guarantee, the course provides expert-led instruction, hands-on training, and placement support, connecting graduates with top employers in India and abroad. In summary, the future of accounting careers is bright, with strong job prospects, high demand for digital and regulatory expertise, and excellent opportunities for long-term growth and stability in a dynamic, technology-driven industry. For more details visit here at: https://www.slaconsultantsindia.com/accounts-taxation-training-course.aspx

E-Accounting, E-Taxation and E-GST Course Modules

Module 1 – Advanced Goods & Services Tax Practitioner Course - By CA– (Indirect Tax)

Module 2 - Part A – Advanced Income Tax Practitioner Certification

Module 2 - Part B - Advanced TDS Practical Course

Module 3 - Part A - Finalization of Balance sheet/Preparation of Financial Statement & Banking-by CA

Module 3 - Part B - Banking & Finance

Module 4 - Customs / Import & Export Procedures - By Chartered Accountant

Module 5 - Part A - Advanced Tally Prime & ERP 9

Module 5 - Part B - Tally Prime & ERP 9 With GST Compliance

Module 7 – Advanced SAP FICO Certification

Contact Us:

SLA Consultants India

82-83, 3rd Floor, Vijay Block,

Above Titan Eye Shop,

Metro Pillar No.52,

Laxmi Nagar, New Delhi - 110092

Call +91- 8700575874

E-Mail: hr@slaconsultantsindia.com

Website: https://www.slaconsultantsindia.com/